After the growing tensions of buoyed prices between the U.S. and Iran, oil futures edged higher in unstable trade. The prices that reached a one-month low in recent past after President Trump announces that he may increase the tax on Chinese goods. The United States West Texas Intermediate crude rises about 31 cents on $62.25 per barrel. Earlier, West Texas Intermediate hit $60.04 in the session, its lowest since 29th March.

Future rose of Brent crude as 39 cents to $71.24 per barrel, once hitting its lowest at $68.79 since 2nd April. The director of energy futures at Mizuho, Bob Yawger said that in early afternoon trade WTI broke through $62 due to which additional buying sparked.

The U.S. is set up a carrier strike group and a bomber task force to Middle East countries after injecting risk premium into the market to convey a transparent message to Iran that any attack on the interests on the United States or its allies will meet with unrelenting force, said John Bolton, the National Security Adviser of United States.

Read Also: Trade Talks between China and the US are on Final Stage – Mnuchin

An analyst at Price Futures Group in Chicago, Phil Flynn said that everyone is watching those increasing geopolitical tensions. The deployment of strains comes after the decision of Trump administration to make tighter energy sanctions on Iran in a bid to drive the Iran exports of oil to zero. The United States stopped allotting sanctions waivers that permit some of the biggest customers of Iran to import limited crude oil from Iran.

World’s Largest Oil Exporter Increase the Crude Oil Prices for Asian and European Countries

Moreover, the biggest oil exporter Saudi Arabia increased its prices of crude oil from June to its European and Asian customers. On the other hand, it cut the crude oil prices for the United States, and it is a sign that the state is in no hurry to enhance the supply of oil ahead of next month OPEC meeting.

Trump about New Tariffs and Investor’s Fear

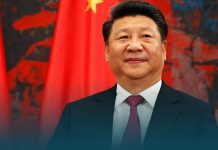

Trump tweeted on his official account to pressurize the market by saying that on Friday the tariffs on 200 billion dollars of goods going to increase to 25%. His this decision is opposite to his February announcement to keep those goods at 10% due to the positivity in the trade talks. On Monday he also tweeted that Sorry they’re not going to do anymore and this tweet was to defend his Sunday statement that cites the trade conflict among China and the United States.

Trump these remarks worried the investors about the progress of trade talks between the two largest economies of the world and ignited fears that current tensions may hurt the oil demand globally. Geng Shuang, Foreign Ministry spokesperson of China gives a news briefing that a delegation of China was still organizing to go to the U.S. for trade talks. He added that they are also in the procedure of accepting the relevant situation.