The government of Argentina enforced currency controls in an effort to steady financial markets, as the third-largest economy of Latin America faces a developing economic crisis. On Sunday, the temporary measures announced that let the government restrict purchases of foreign currency after a sharp drop in the super-sensitive peso. Now, all firms must ask permission from the central bank of Argentina to sell pesos and purchase foreign currency to do transfers in a foreign country.

On Sunday, the government said in the official statement issued that controls of currency were necessary to certify the regular functioning of the economy. The current move follows the disclosure announcement on Wednesday that Argentina would seek out to submit payments on approximately $100 billion of debt that credit rating agency S&P categorized as a default in its own criteria.

The actions that will still in place till the end of the year constitute a surprising turnaround for Mauricio Macri, the President. In a while, the latest after beginning his terms in 2015 December, the battered leader of the second-largest country of South America shortly removed strict capital controls which had in place since 2011. The central bank and the government of Macri are making efforts to reinforce confidence in financial markets ahead of coming presidential election on October 27.

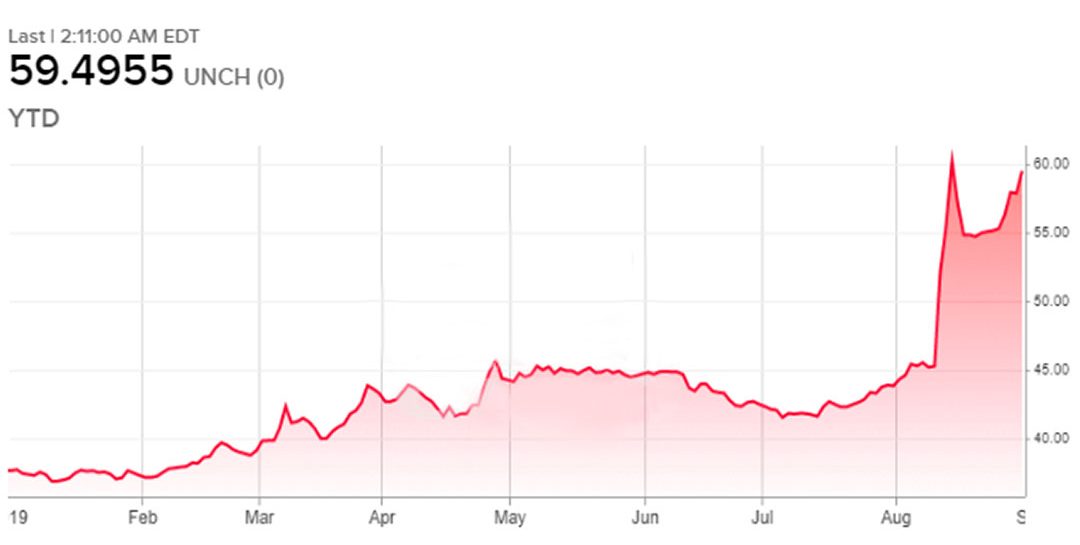

Argentine Peso/US Dollar FX Spot Rate (ARS=Exchange)

The participants of the market expected a few types of capital controls from the government of Argentina. But, few worried the move could threaten the IMF (the International Monetary Fund) current costs of its historic $57 billion program of the bailout.

Aberdeen Standard Investments’ senior investment manager, James Athey said that he still has the belief that the IMF will provide another $5.4 billion tranches to Argentina late this month. Fundamentally, the IMF does not want to be the one that drew the plug. Athey debated credit rating organizations had the same issue when it moves toward Argentina with several of them rushing to relegate the country to junk status in the last few weeks.