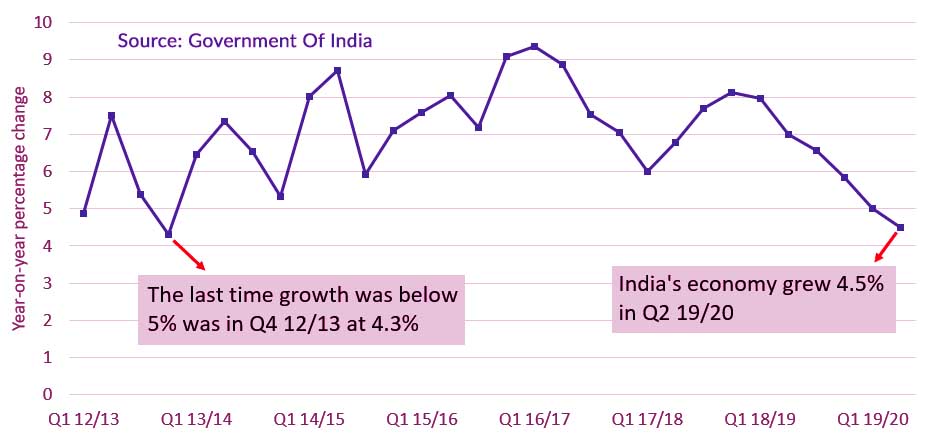

On Thursday, Central bank of India expected to slash rates after the latest statistics revealed economic growth decelerated to a six-year low. In contrast, economists asked the efficacy of further rate cuts. The Reserve Bank of India already dropped its repo rate – or the rate at which it offers loans to commercial banks – by 135 root points since Jan to lift the economy, making it one of the most invasive central banks at present. The present repo rate is around 5.15%. According to Citi analysts, Baqar M Zaidi and Samiran Chakraborty, still, ample extra liquidity in the banking system and the growing cut-rate resulted in only a sixty-basis-point drop in lending rates for new loans and too much lower for all outstanding loans.

They wrote in a note that this transmission lack raised severe concerns about the effectiveness of economic policy transmission in the environment of serious risk aversion as well as other structural stiffnesses. Still, it will hard for any state’s central bank to admit that. Reuters reported that on average, the economists predicted the RBI to cut its repo rate by twenty-five basis points to around 4.90% this week and then by another fifteen basis points in the 2nd quarter of 2020.

GDP Growth of India

Supposedly, when any central bank cuts loaning rates to commercial banks, those financiers might send the rate cuts to consumers in the shape of loans. However, many Indian lenders are struggling with a large number of non-performing assets weighing on their balance sheets. That makes them uncertain about sharing the complete benefits of a lower cost of borrowing to customers. Head of strategy and economics at Mizuho Bank, Vishnu Varathan wrote in a note that policy transmission delayed by credit back-up along with liquidity risks in the banking as well as shadow banking sectors interrogate the effectiveness of further rate cuts, that come at an increasing cost to rupee and macro stability.

In September, the RBA made it compulsory for banks to link specific categories of loans to an external benchmark system to find interest rates for consumers. Banks that use the repo rate of RBI as the standard would have to adjust their loaning rates according to the subsequent moves of the central bank.

The Reserve Bank of India’s Policy Dilemma

A close reading of the headline growth number of India for the three months to September displayed public spending helped strengthen the overall GDP number. According to India economist at Societe Generale, Kunal Kundu, the government is shortening room for continuous expenditure to inflate the economy. Adding to that, collection of tax revenue expected to rather underwhelming given that insignificant GDP growth fell to its lowest level ever, a worsening of the ultimate fiscal shortfall remains a distinct possibility. The fiscal deficit target of the budget at present is about 3.3% of GDP, and if it extends too much, then the confidence of investors might take a hit.

Moody’s, a rating agency, recently downgraded its stance on India from stable to negative. Kundu wrote that with the government missing the fiscal space to drive the economy, they think that the policy of RBI easing stance probably to continue regardless of the noticeable lack of effectiveness. Adding that, he expects the central bank of India to cut rates further by fifty basis points for the complete fiscal year, together with a twenty-five-basis point cut this week. Whereas, fiscal easing yet to produce the type of results Indian legislators are hoping for, price increases are becoming an apparent matter. The medium-term inflation target of the RBI till 2021 is four percent, with upper and lower tolerance limits being two percent and six percent, respectively.

India’s Annual Retail Inflation Rate

However, the annual retail inflation of India rose to 4.62 percent in October on the back of higher prices of foods. Rising inflation and slowing growth leave the Reserve Bank of India on a “perilous tight rope,” Varathan said. He added, the inflation outbreak is mainly a supply-side issue driven by increasing food prices that don’t need a strong policy response. Whereas, the optics of supposed worse or indifference, unabated cuts, amid quick inflation rebound is non-ideal. Varathan explained that the expected rate cut of RBI would negotiate the stability of the rupee (Indian currency) and the broader macroeconomic environment. The policy dilemma of the central bank will only strengthen near-term as growth pressures set to keep on, and food-related inflation looks poised to surprise.

Citi analysts Zaidi and Chakraborty added that the RBI requires to observe fluctuations in prices of food, mainly vegetable prices, for some more months and check whether these are nourishing into domestic inflation expectations. The Citi analysts said that keeping the accommodative stance and letting the door open for a future rate cut will become the toughest challenge for the Reserve Bank of India.

Read Also: GDP Growth of India falls to sluggish price since 2013