Google is teaming up with Jio Platforms, the Indian tech giant company, to win over more smartphone users. The latest move should worry the Chinese tech firms who long dominated the Indian market, the second-most populous country in the world. Last week, the Silicon Valley giant announced that it is investing $4.5 billion into Jio Platforms. This mobile phone carrier-turned-technology juggernaut caught a slew of giant investors this year.

Google is wading into a market that China wants (wanted) to own. India. Chinese sales accounted for 75% of the market here till now.450 million Indians have smartphones,500 million don’t yet own them.Anti China sentiment plus India 1st initiative r drivers https://t.co/oVVYcO0pk6

— Smita Prakash (@smitaprakash) July 25, 2020

Some of that investment will use to develop a super-economical smartphone tailor-made for the Indian local market – a device that might help Jio and Google to capture some of the halves a billion Indian nation who still want to own their first smartphone, majority of them belongs to rural areas. Venders revealed dome of the details of the new cheap phone.

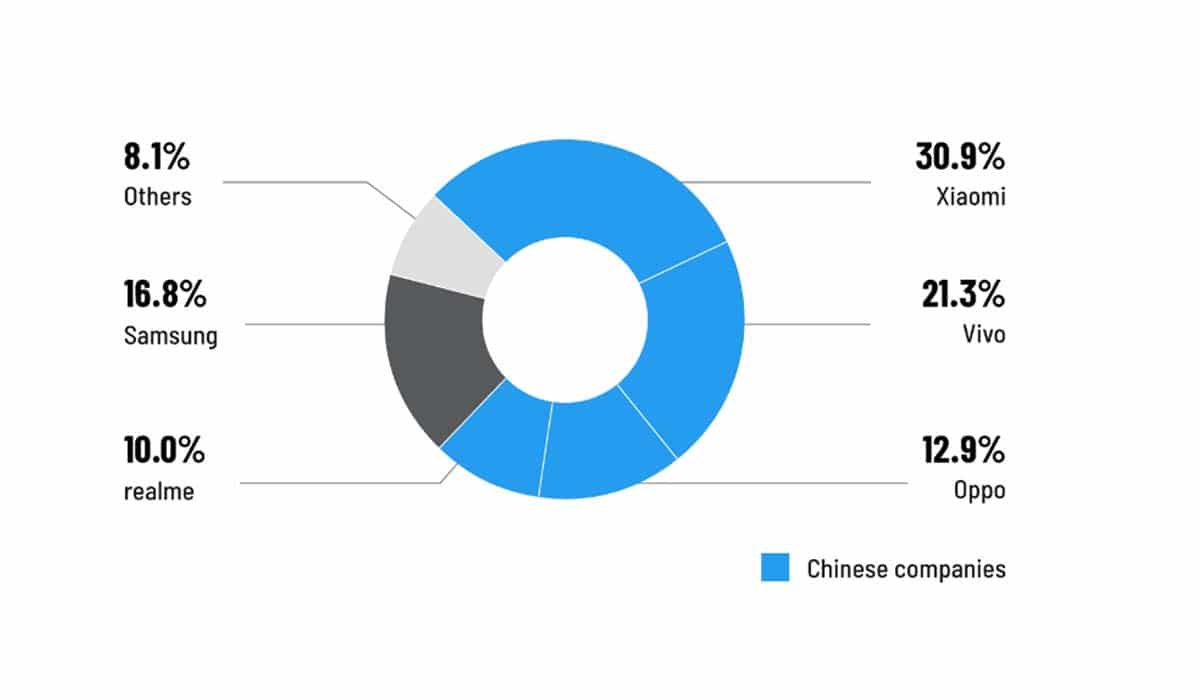

According to research firm Canalys, the deal suggests that Google and Jio mutually might shake up the market where gigantic Chinese brands accounted for over seventy-five percent of overall sales in the quarter that ended in June. Samsung of South Korea was number three seller with only under seventeen percent. A cheap, initial-level smartphone from Google and Jio might bad news for Chinese smartphone manufacturers making an effort to step forward with first-time Indian smartphone users, according to senior research manager at IDC, Kiranjeet Kaur.

Anti-China sentiment in India

A smartphone from Jio might also attain benefit from rising ant-China sentiment in India to stop using Chinese products. Recently, the government of India banned TikTok and several other Chinese apps after deadly clashes between Indian and Chinese troops, and several Indians called for boycotts of Chinese products.

An untouched market

Much has been made of mounting mobile internet market in India. According to Counterpoint Research, approximately 450 million Indians are already using their own smartphones. They depend on them to shop, order food, hail rides, and stream content on the web. However, around five hundred million people do not yet own these types of devices – and Jio and Google want to provide them a cheap way in.

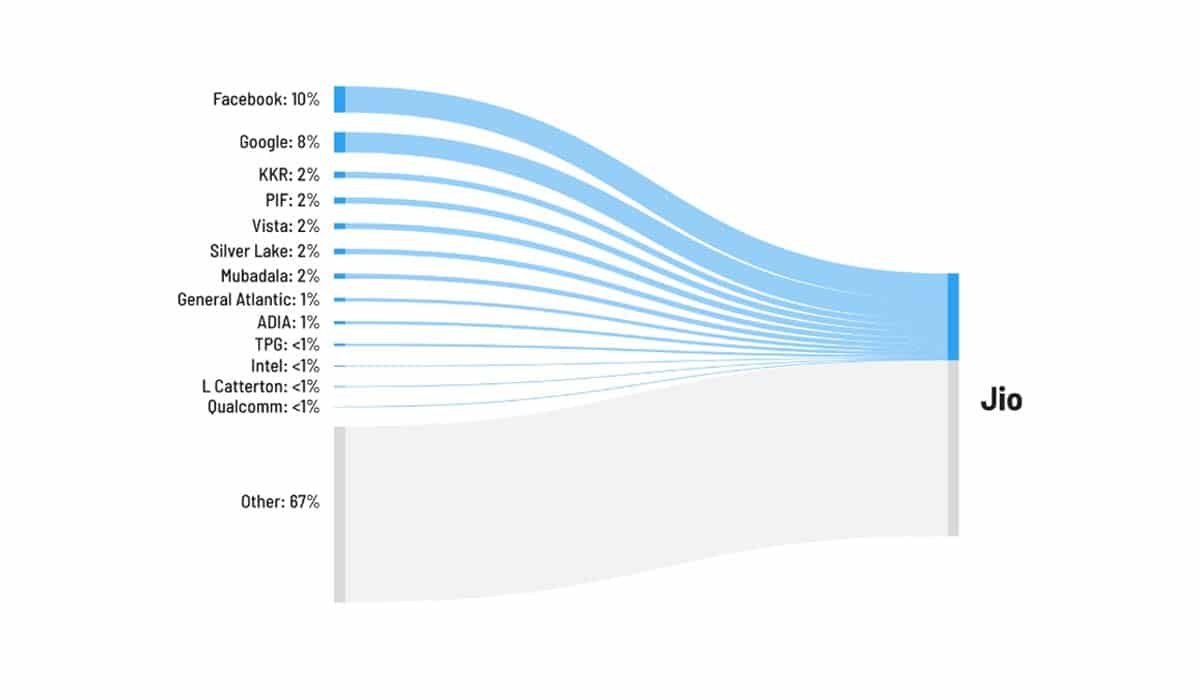

Jio sold a thirty-three percent stake to some A-list investors

Some of the biggest brands of Silicon Valley and major investors invested in the rapidly-growing tech company of Mukesh Ambani this year.

Source: Jio

The richest man in Asia and the CEO of Jio parent company Reliance Industries, Mukesh Ambani, said during a company event last week that they should not deprived of the data and digital revolution. Further, he explains that the partnership of Jio with Google aims to design smartphones for a fraction of what they at present cost.

Associate director at Counter Research, Tarun Pathak says that Jio is a firm that mainly focuses on the rural side of the country because that is India’s actual face. Tech companies yet have a big funnel of users who are still to come and experience the taste and fun of the internet for the first time.

Most of the people living in rural areas use feature phones – old mobile phones with numeric pads and basic screens – on the 2G network of India. Getting those people on 4G or 5G smartphones would a win-win for both firms; Pathak adds because Jio has the capability to provide new users with data plans, whereas Google serves them to search, maps, YouTube, and other smartphones applications.

Domination of Chinese smartphone makers in India

As of the second quarter of 2020, Chinese smartphone manufacturers dominated the Indian market. Among the top five smartphone sellers, Samsung was the only non-Chinese brand.

Source: Canalys

Jio already sells economical 4G feature smartphones with basic data plans to access the internet facility and run stripped-down versions of a few applications. However, according to Pathak, less than twenty percent of the feature phone users of India are on Jio devices.

To reach the massive low-tier market of India, IDC analyst and Counterpoint Research say the two firms would develop an Android-based smartphone for below than $50. That might be hard to achieve. The Indian budget smartphone market right now is full of phones that usually sell for $70 to $100. According to IDC, Xiaomi leads that category with forty percent of the market, followed by Samsung with seventeen percent and Realme with eleven percent.

Moreover, Kaur noted that expensive parts like chips, memory, and display panels usually inflate the price, pushing smartphones more than the $50 range. And even a $50 price tag is above most rural Indians can afford.

However, if Google and Jio can pull it off – and get those smartphone users to stick with them for upcoming upgrades – that might be a big loss for China’s smartphone makers. Foreign policy advisory board Gateway House of India expects the smartphone users of the country to double to nine hundred million 2025, as income levels increase and smartphones get cheaper.

The upside for Jio and Google

Selling extremely cheap smartphones probably won’t make Jio a lot of money. The firm will be making minor margins on the hardware, or more possibly, will have to subsidize the cost of the thee devices by bundling them with other phone and data services. However, an effective innovation would get millions of more Indian users onto ecosystems owned and controlled by Google and Jio.

Pathak said that Jio already offers a series of apps to shop online, stream music and watch movies. For Google, it’s less about money but more about profiling users. He explains that the more users Google can add to its Android system, the more they can sell ads to these users, which the ultimate goal of the firm. Advertising makes up the massive majority of Alphabet’s revenues, the parent company of Google, responsible for over eighty percent of $162 billion hauls of 2019.

The director at Gateway House, Blaise Fernandes, says that India is also a dream country to invest for any tech firm given the diversity. According to Statista, Android already has a lock on the Indian smartphone market, responsible for ninety-one percent of the smartphone operating systems in use there in the previous year.

Read Also: Elon Musk announces location for second U.S. car factory